Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

Navigating Year-End Property Tax Assessments

As the year draws to a close, it's important for homeowners in Northern Virginia to understand the ins and outs of property taxes and how year-end assessments can impact their financial planning. Here’s a breakdown of what you need to know to navigate the property tax landscape effectively.

What Are Property Taxes?

Property taxes are levied by local governments and are based on the assessed value of your property. These taxes fund essential services in your community, including schools, public safety, infrastructure, and more. In Northern Virginia, property taxes can vary significantly depending on the locality, so it’s crucial to stay informed about your specific area.

How Are Property Taxes Assessed?

Assessment Process: Each year, the local tax assessor evaluates properties to determine their market value. This assessment can include a physical inspection and analysis of recent sales in the area.

Assessment Ratio: In Virginia, the property is typically assessed at 100% of its market value. This means that if your home is valued at $400,000, your assessment would also be $400,000.

Tax Rate: Once the assessed value is determined, it’s multiplied by the local tax rate to calculate your property tax bill. Tax rates can change annually, so it's wise to check for any adjustments that may affect your payments.

Key Dates to Remember

Assessment Notices: Homeowners usually receive their property assessment notices in the spring. This notice provides details on your property’s assessed value and any changes from the previous year.

Appeal Period: If you believe your assessment is too high, you have the right to appeal. Northern Virginia typically allows a window for appeals after the assessment notices are sent out.

Year-End Payments: Property taxes in Virginia are often due twice a year, with the second payment typically falling in December. Be sure to check your local tax office for specific dates and payment options.

What Homeowners Should Be Aware Of

Keep Track of Changes: Home improvements, renovations, or changes in the neighborhood can affect your property’s value. Stay updated on local real estate trends and how they may impact your assessment.

Budgeting for Taxes: As you prepare for year-end expenses, include property taxes in your financial planning. This will help you avoid any surprises when it comes time to make your payments.

Understanding Exemptions: Virginia offers various tax exemptions and relief programs for qualifying homeowners, such as the elderly or disabled. Research these options to see if you may be eligible for any benefits that can reduce your tax burden.

Consult a Professional: If you’re uncertain about your assessment or how to navigate the property tax system, consider consulting a tax advisor or real estate professional. They can provide valuable insights and help you understand your options.

Being proactive about understanding property taxes and preparing for year-end assessments can save homeowners in Northern Virginia both money and stress. By keeping informed, budgeting wisely, and taking advantage of available resources, you can ensure that your property taxes align with your financial goals. As you wrap up the year, take the time to review your property tax situation and make informed decisions for the future!

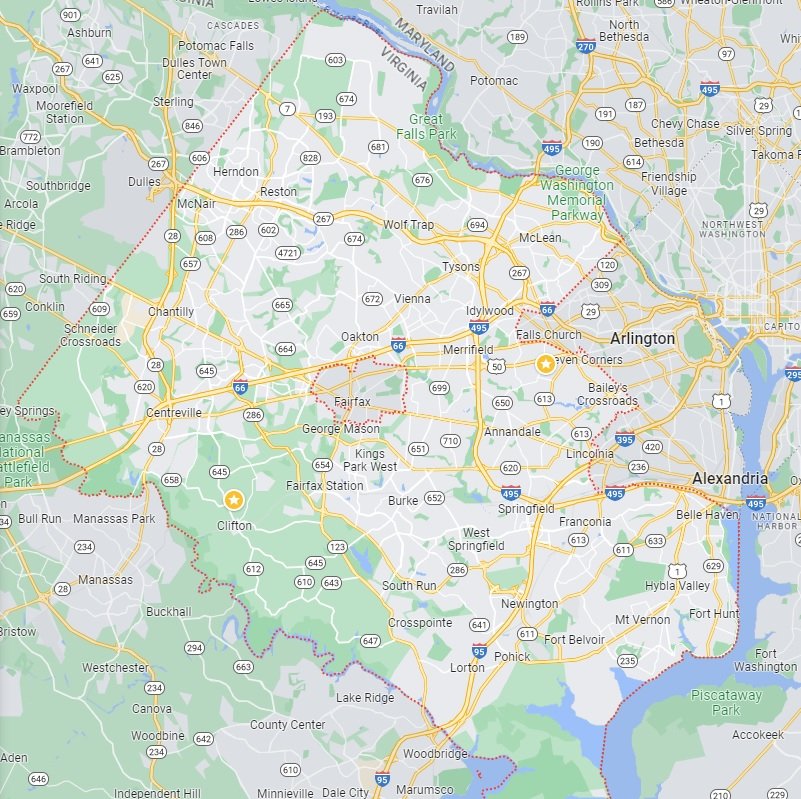

Fairfax County Homes for Sale

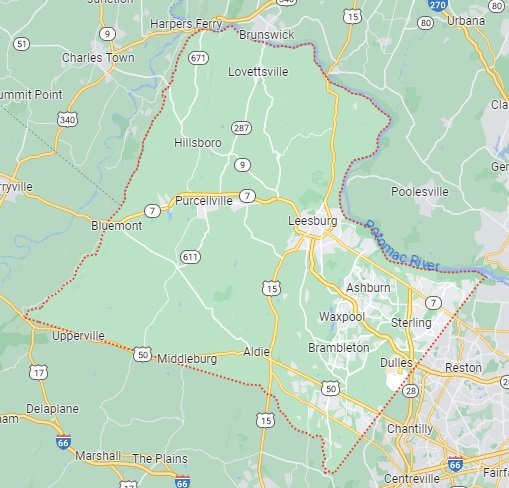

Loudoun County Homes for Sale

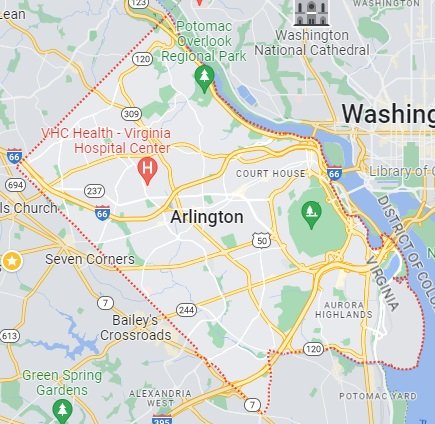

Arlington County Homes for Sale

Prince William County Homes for Sale