Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

What Every Homeowner and Investor Should Know

Real estate transactions come with tax responsibilities that can affect your bottom line. Whether you're a homeowner, investor, or real estate agent, understanding these tax implications is essential for making smart financial moves.

Capital Gains Tax

If you sell a property for a profit, you may owe capital gains tax. However, homeowners who have lived in their primary residence for at least two out of the last five years can often exclude up to $250,000 ($500,000 for married couples) from taxable income. Investors, on the other hand, may explore 1031 exchanges to defer capital gains tax when reinvesting in new properties.

Property Taxes

Local governments assess property taxes based on the value of real estate. These taxes fund public services like schools and infrastructure. Rates vary by county, so it’s essential to understand your local tax obligations.

Tax Deductions for Homeowners

Homeowners can take advantage of deductions, including mortgage interest and property taxes, which can reduce taxable income. Additionally, energy-efficient home improvements may qualify for tax credits.

Real Estate Investors & Depreciation

Investors benefit from depreciation, which allows them to deduct the cost of their property over time, lowering taxable income. This can be a valuable tool for offsetting rental income.

Staying Informed

Tax laws can change, so staying informed is key. Consulting with a tax professional ensures compliance and maximizes potential savings.

Understanding real estate taxes doesn’t have to be overwhelming. With the right knowledge and strategy, you can navigate your tax obligations while making the most of your investments.

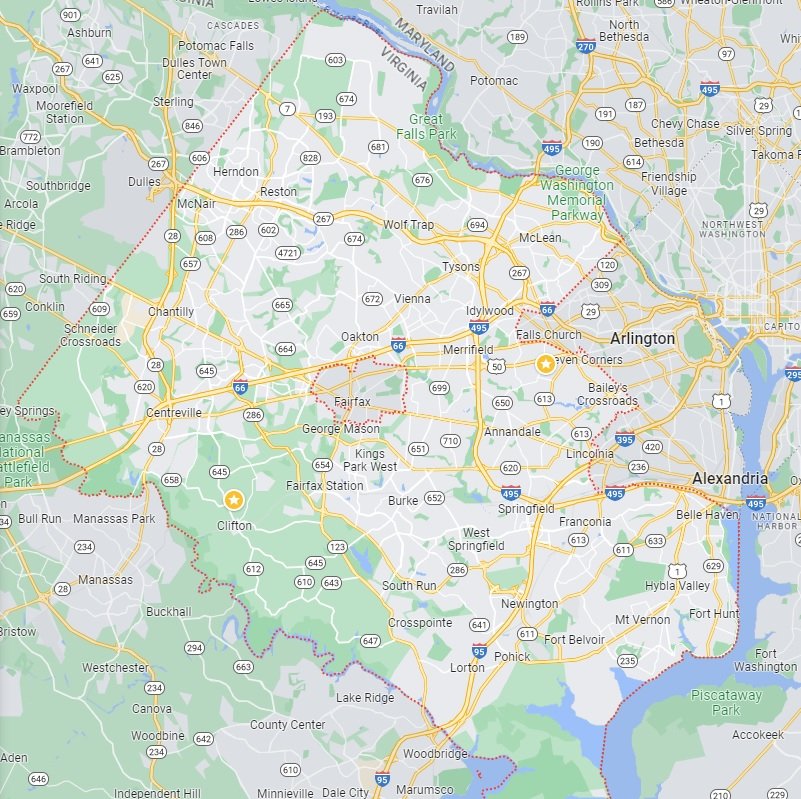

Fairfax County Homes for Sale

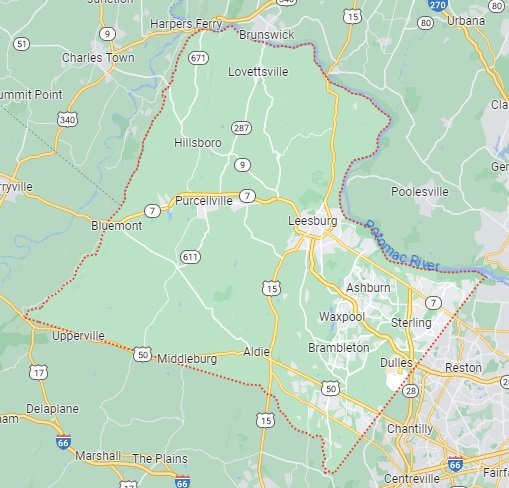

Loudoun County Homes for Sale

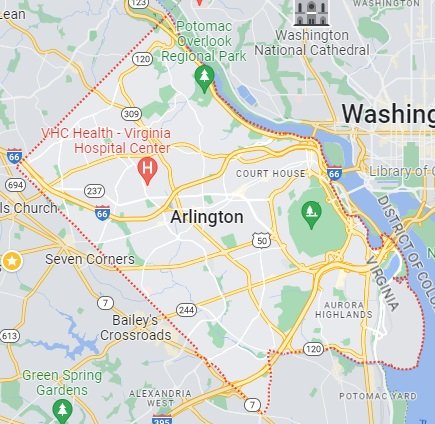

Arlington County Homes for Sale

Prince William County Homes for Sale