Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

Understanding Assessments and Appeals for Effective Financial Management

Navigating property taxes can be challenging, especially in Northern Virginia, where rates and assessments vary across counties and municipalities. As a homeowner, understanding how property taxes work and what factors influence them is crucial to managing your finances effectively. This guide will explain the basics of property taxes in the region and offer tips on appealing property assessments if needed.

How Property Taxes Work

Property taxes in Northern Virginia are calculated based on two main factors: the assessed value of your property and the local tax rate. Local assessors evaluate properties annually to determine their fair market value, considering factors like size, location, and condition. Homeowners receive a notice detailing their property's assessed value.

Local governments set a tax rate, expressed as a percentage or amount per $100 of assessed value. These rates vary between counties and cities and are determined through the local government's budget process. Your property tax bill is calculated by multiplying your property's assessed value by the local tax rate. For example, a $500,000 home with a 1% tax rate results in a $5,000 annual tax.

What Homeowners Should Know

Regular reassessments mean that property values and tax rates change annually, so it’s important to review your assessment notice each year for accuracy. Including property taxes in your budgeting process can help you avoid surprises, and being aware of payment deadlines will help you avoid late fees. Most areas offer semi-annual or quarterly payment options.

Tips for Appealing Property Assessments

If you believe your property's assessed value is too high, you have the right to appeal. Start by reviewing your assessment notice for errors or inconsistencies. Research comparable properties to identify discrepancies, and discuss your concerns with your local assessor's office for an informal review.

If necessary, you can file a formal appeal by submitting a written request with supporting documentation to your locality's Board of Equalization. Prepare for the hearing by presenting clear evidence and data from comparable properties. Seeking professional assistance from an appraiser or real estate agent can also provide expert support.

Understanding property taxes in Northern Virginia is vital for managing your finances. By staying informed about assessments and knowing how to appeal, you can ensure your tax bill is fair. Regularly review your assessment notice and monitor local tax rate changes to navigate property taxes with confidence.

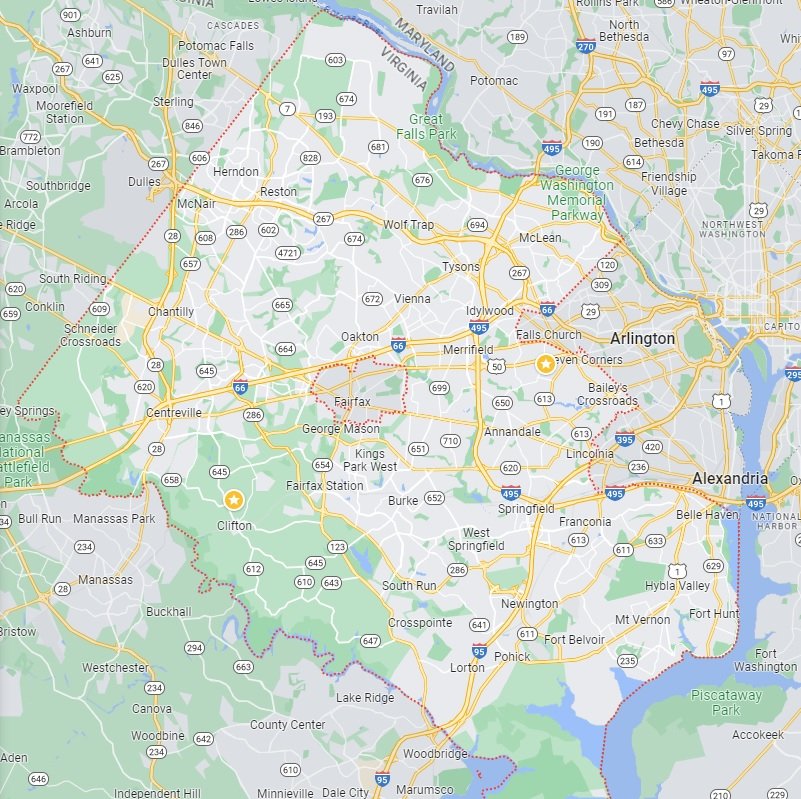

Fairfax County Homes for Sale

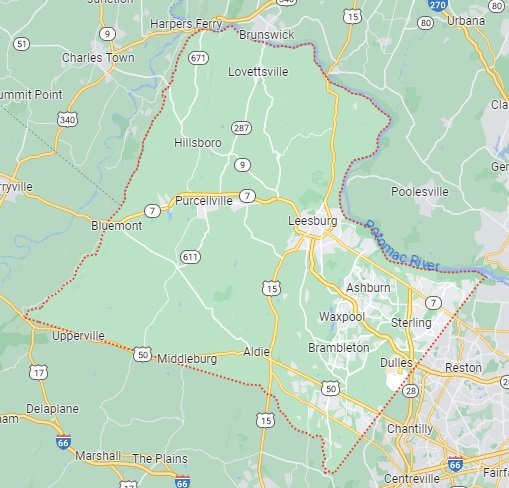

Loudoun County Homes for Sale

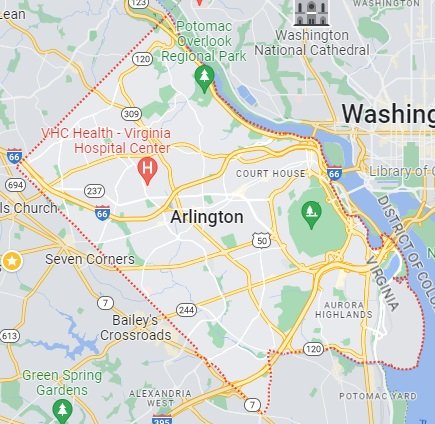

Arlington County Homes for Sale

Prince William County Homes for Sale