Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

Maximize Your Investments with the 1031 Exchange: A Guide to Tax Deferral and Property Reinvestment

A 1031 exchange, which derives its name from Section 1031 of the IR code, allows the investor to sell a property and buy another property with the proceeds from the sale. This process enables one to defer capital gains taxes on the sale, possibly indefinitely, if one continues reinvesting in other properties.

It is recommended that you first sell your current investment property. Then, within the next 45 days from the sale of your property, you should be able to identify one or more potential replacement properties. This is because the timeline followed is rather strict, and one is expected to always stick to it.

You need to acquire the new investment property within 180 days of selling your property. The funds received from the sale must be managed by a qualified middleman. This ensures that the funds involved in the QI process are not mixed with your other funds and thus preserves the aspect of the 1031 exchange.

Thus, you can reinvest the entire amount of your proceeds without having to pay capital gains taxes. Using 1031 exchanges multiple times, you can build up your investments and get better and better properties.

It must be mentioned that though 1031 exchanges are beneficial, they have specific rules and regulations that must be followed. You cannot claim your exchange if you fail to report it within the first 45 days or if you buy the property within 180 days; this attracts immediate tax consequences.

Affirmation of the QI is a requirement when dealing with the IRS to avoid any form of noncompliance with the regulations. The 1031 exchange process has many rules that must be followed, and it is advisable to consult a tax professional or a real estate professional for assistance.

A 1031 exchange is an excellent way for real estate investors to expand their real estate investments and postpone taxes. Knowing its dynamics and following the rules provided in this article, you can accumulate a large amount of capital in the future.

It is advisable to seek advice from your tax consultant on the law prevailing at the time of investment to ensure compliance with legal provisions and to enhance returns from your real estate investment.

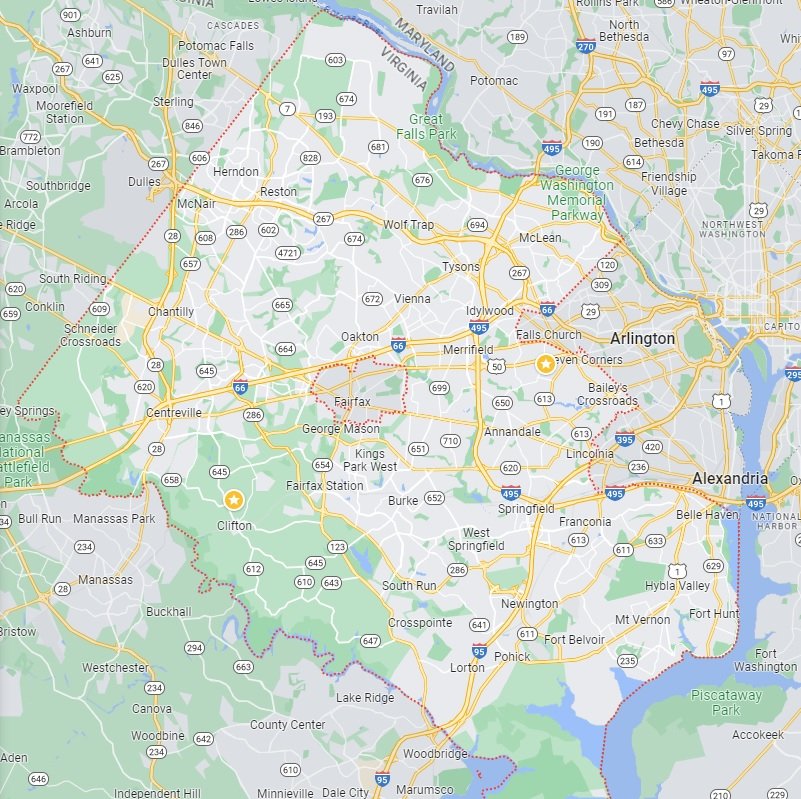

Fairfax County Homes for Sale

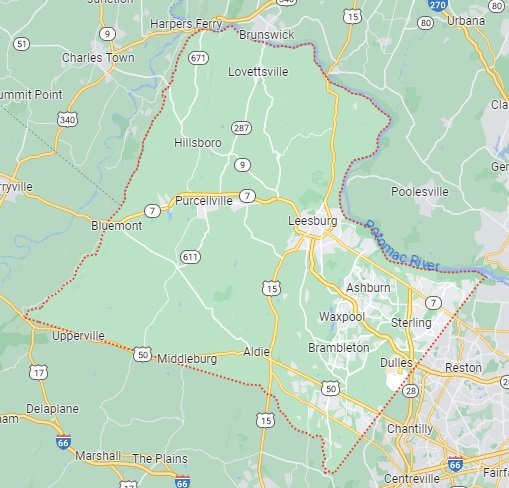

Loudoun County Homes for Sale

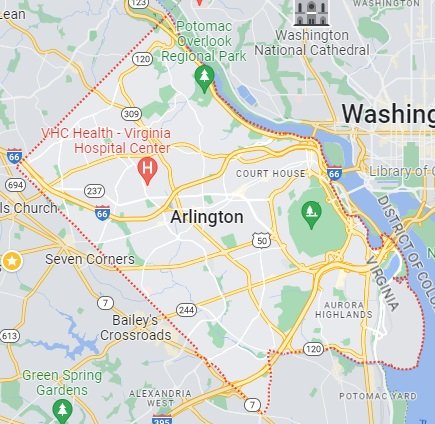

Arlington County Homes for Sale

Prince William County Homes for Sale