Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

A Closer Look at How Property Taxes Affect Your Home and Budget

For homeowners in Northern Virginia, property taxes are an inevitable part of owning real estate. Understanding how these taxes are calculated, what influences their rates, and how they can impact your budget is essential for both current homeowners and those looking to buy. Here's what you need to know about navigating property taxes in NOVA.

What Are Property Taxes and How Are They Calculated?

Property taxes in NOVA are local taxes levied by counties and cities to fund public services such as schools, infrastructure, and emergency services. These taxes are calculated based on the assessed value of your property, which includes both the land and any buildings on it. The tax rate, known as the mill rate, is applied to every $1,000 of assessed value.

Factors That Influence Property Taxes in NOVA

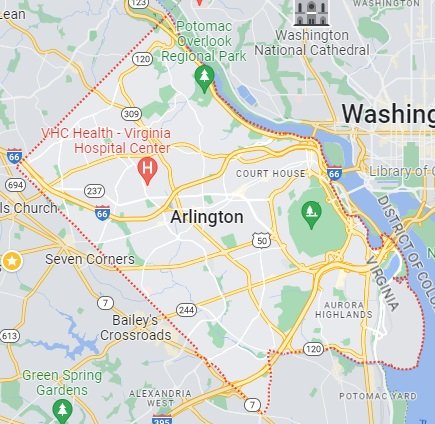

Location: Different counties and cities within NOVA have varying tax rates. For instance, Arlington County’s rates might differ significantly from those in Fairfax County or Alexandria.

Property Value Assessments: Assessors evaluate your property's market value annually or biannually. Significant improvements to your home, like a new addition or major renovations, can increase your property’s assessed value and, consequently, your tax bill.

Local Budgets and Needs: Property tax rates can change based on the funding needs of local governments. If a county decides to increase spending on public schools or infrastructure, tax rates may rise to meet these financial requirements.

How to Appeal a Property Tax Assessment

If you believe your property has been overvalued, you have the right to appeal the assessment. Most counties provide a formal appeal process where you can present evidence, such as recent appraisals or sales data from similar properties, to argue that your property is over-assessed.

Tips for Managing Your Property Tax Bill

Stay Informed: Regularly review your property assessment notices and understand how your taxes are being calculated.

Consider Tax Relief Programs: NOVA offers various tax relief programs for seniors, veterans, and low-income homeowners. Check your eligibility for potential savings.

Plan for Increases: As property values and local budgets fluctuate, anticipate possible increases in your property tax bill and plan your finances accordingly.

Understanding property taxes is crucial for managing your budget as a homeowner in NOVA. By staying informed about how your property is assessed and being aware of factors that could affect your tax rate, you can better navigate the complexities of property taxes and make more informed decisions about your home.

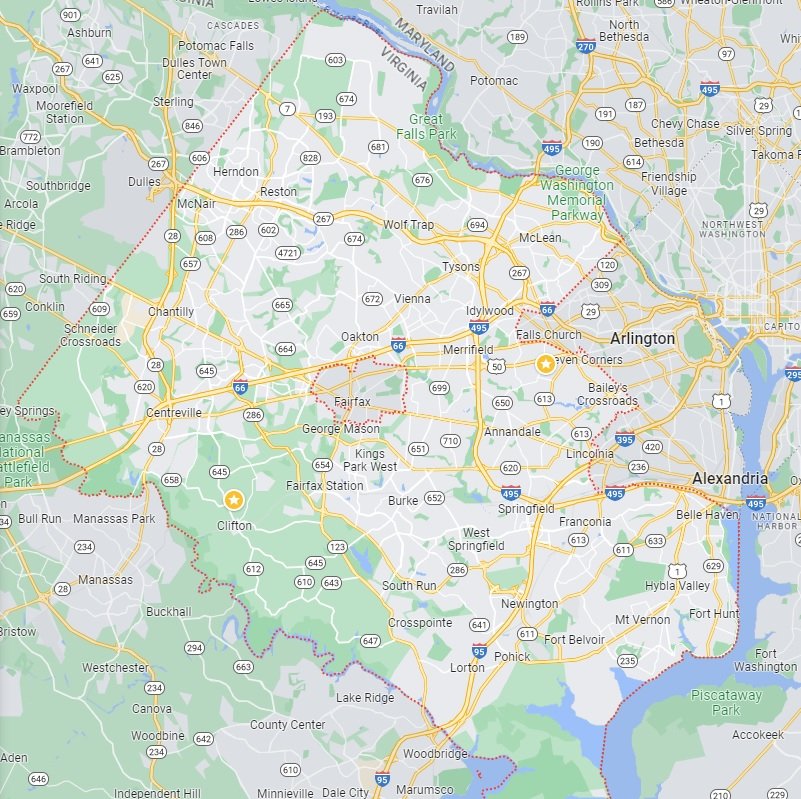

Fairfax County Homes for Sale

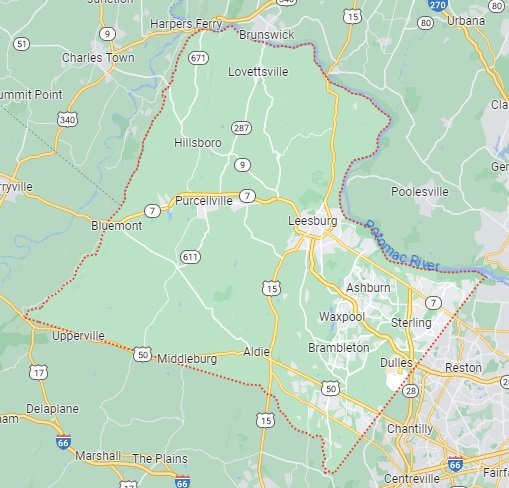

Loudoun County Homes for Sale

Arlington County Homes for Sale

Prince William County Homes for Sale