Buying or Selling a home Can be Stressful! 😵

The Experienced Greetings DMV Sales Network Agents Will Help You Find YOUR Home Or Sell Your House,

So You Have More Money, Comfort, And Achieve Your Goals Throughout The Process.

Smart Strategies for Success in Property Investing

Real estate can be one of the most rewarding investments, but without the right approach, it’s easy to fall into common traps that can hurt your returns. Whether you’re just starting or looking to expand your portfolio, understanding the top mistakes investors make—and how to avoid them—can make all the difference in your long-term success.

Not Doing Enough Research Mistake: Rushing into a property purchase without understanding the local market, neighborhood trends, and potential for future growth. How to Avoid It: Take the time to research the location, property values, and the area's long-term prospects. Utilize resources like local real estate reports, market forecasts, and online property databases.

Overleveraging Mistake: Taking on too much debt, assuming that high leverage will lead to higher returns. How to Avoid It: Stick to a conservative loan-to-value (LTV) ratio and ensure you have a solid cushion of reserves to cover any unexpected expenses.

Ignoring Cash Flow Mistake: Focusing too much on appreciation and ignoring the importance of rental income and cash flow. How to Avoid It: Analyze the property's potential cash flow before purchasing. Make sure the income generated from the property covers your expenses, including mortgage, taxes, and maintenance.

Underestimating Maintenance Costs Mistake: Failing to account for ongoing maintenance costs and unexpected repairs. How to Avoid It: Budget for repairs and set aside an emergency fund. Consider the age of the property and the condition of major systems like HVAC, plumbing, and roofing.

Not Diversifying Mistake: Investing in a single property or location without diversification. How to Avoid It: Diversify your portfolio by investing in different types of properties (residential, commercial) or locations. This reduces risk and increases long-term stability.

Ignoring Property Management Mistake: Trying to manage properties on your own without sufficient knowledge or experience. How to Avoid It: Consider hiring a professional property manager who understands the nuances of tenant relations, maintenance, and legal requirements.

Misjudging the Market Cycle Mistake: Buying during a market peak or at a time of inflated prices. How to Avoid It: Learn to read market cycles and understand when it's the right time to buy. Be patient and wait for a buyer's market or downturn to make more strategic purchases.

Failing to Account for Taxes Mistake: Overlooking the impact of property taxes and capital gains taxes on investment returns. How to Avoid It: Understand the tax implications of your investment, including local property taxes, deductions, and long-term capital gains. Consult with a tax professional for advice.

Ignoring the Condition of the Property Mistake: Purchasing a property without properly assessing its condition, leading to surprise costs. How to Avoid It: Conduct a thorough inspection before buying. Hire professionals to check for any structural or environmental issues that could lead to expensive repairs.

Not Having an Exit Strategy Mistake: Failing to plan for how you'll sell or exit the investment if things don’t go as planned. How to Avoid It: Always have an exit strategy in place. Know your options for selling, renting, or refinancing, and ensure that your goals are aligned with the current and future market conditions.

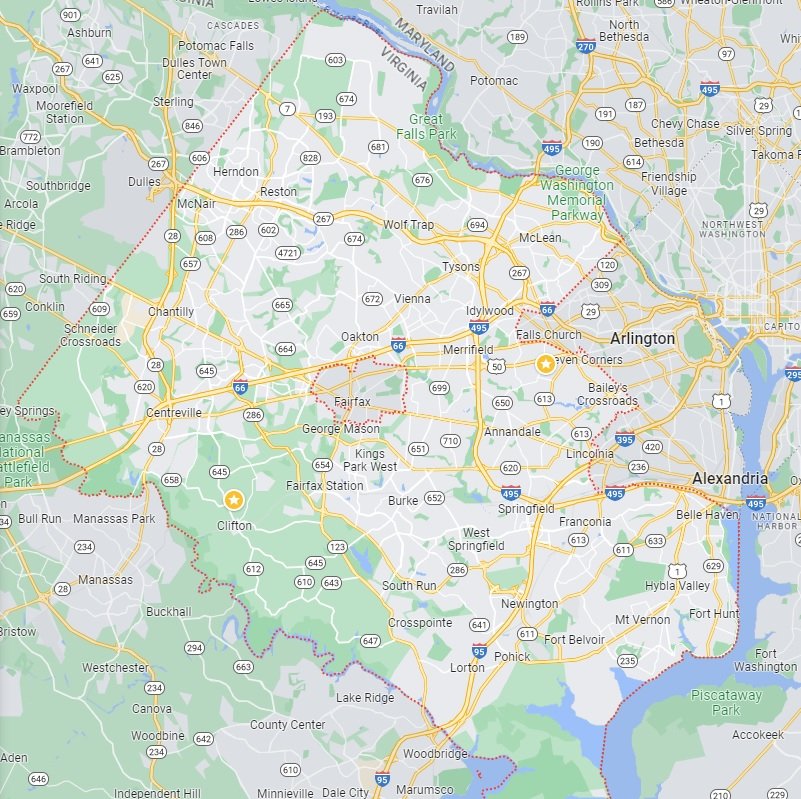

Fairfax County Homes for Sale

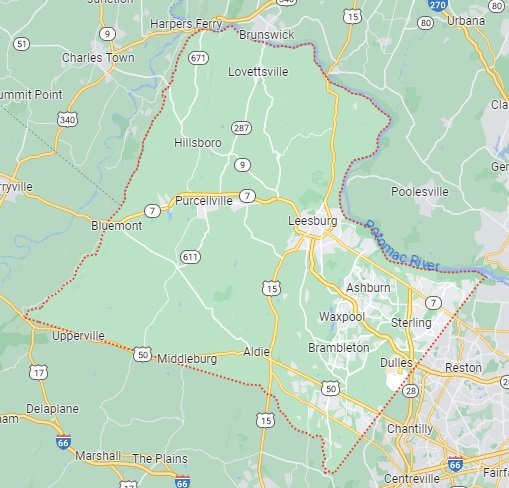

Loudoun County Homes for Sale

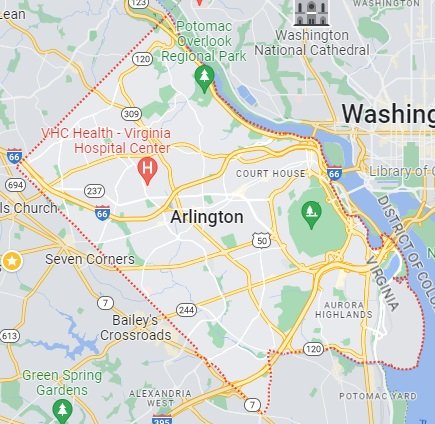

Arlington County Homes for Sale

Prince William County Homes for Sale