Smarter Real Estate Starts Here

Buy, Sell, or Invest with Trusted Virginia and DMV Experts

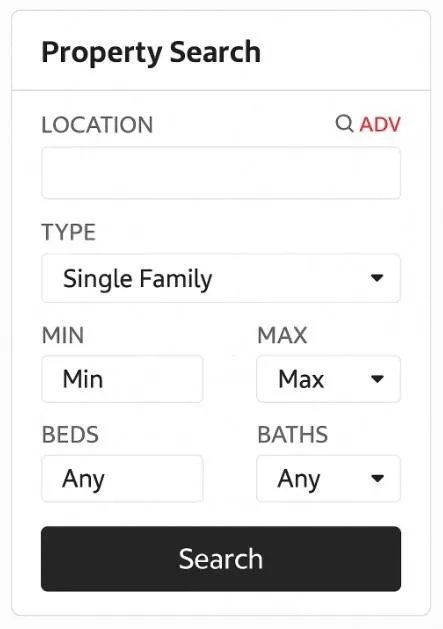

Find Your Perfect Home

Watch the Dream Home Buyer Webinar (Free)

Instant Sale

We buy your

home in 7 days

Seller: Option 1

Upgrade Now

You Repair -

We Fund and Manage

Seller: Option 2

High Tech Selling

Unlock AI, Big-Data, and Technology

Seller: Option 3

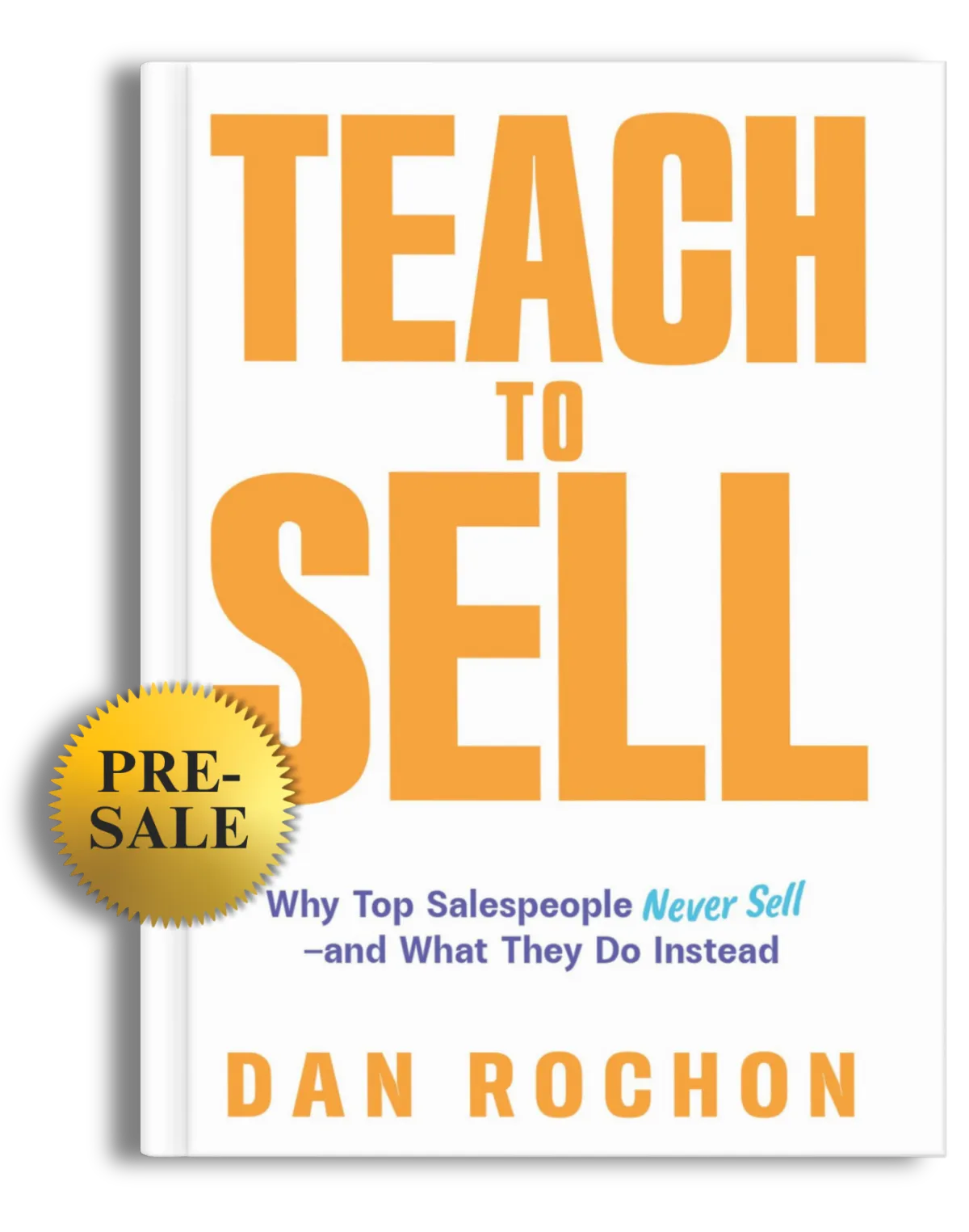

Meet

Dan Rochon, Your Guide

"I’ve been helping people buy and sell homes in the DMV since 2007.

If there’s a corner of this market I don’t know, it probably doesn’t exist.

Along the way, I learned a vital truth: great service only happens with great people.

That’s why I only work with top-tier talent—professionals who are as committed to your success as I am.

I’ve taught hundreds of real estate agents how to get licensed and thrive.

I even owned one of the largest brokerages in the region, overseeing thousands of home sales every year.

Today, my team serves the DMV and all of Virginia—from the DMV to Richmond, Hampton Roads, and Roanoke.

So when I say there’s a smarter, calmer, more strategic way to buy or sell a home?

I’m not guessing.

I built the system.

And I’ve built the team to deliver it—flawlessly.

Let’s do this the smart way."

-Dan Rochon

Your Dream Home is Closer Than You Think! Watch the FREE

Dream Home Finder Webinar

and Unlock the Secrets to Finding Your Perfect Home!

Find Your Perfect Home

Watch the Dream Home Buyer Webinar (Free)

Instant Sale

We buy your

home in 7 days

Upgrade Now

You Repair -

We Fund and Manage

High Tech Selling

Unlock AI, Big-Data, and Technology

Meet Dan Rochon, Your Guide

"I’ve been helping people buy and sell homes in the DMV since 2007.

If there’s a corner of this market I don’t know, it probably doesn’t exist.

Along the way, I learned a vital truth: great service only happens with great people.

That’s why I only work with top-tier talent—professionals who are as committed to your success as I am.

I’ve taught hundreds of real estate agents how to get licensed and thrive.

I even owned one of the largest brokerages in the region, overseeing thousands of home sales every year.

So when I say there’s a smarter, calmer, more strategic way to buy or sell a home?

I’m not guessing.

I built the system.

And I’ve built the team to deliver it—flawlessly.

Let’s do this the smart way."

Your Dream Home is Closer Than You Think! Watch the FREE Dream Home Finder Webinar

and Unlock the Secrets to Your Perfect Home!

If you don’t own real estate, you’re paying for someone who does.

Advisors

Trusted guides for real estate investors, buyers, and sellers. Our Advisors don’t just sell homes—they help you make smart, strategic moves that build long-term wealth. Insightful, ethical, and results-driven.

Negotiators

Masters of the deal. Our Negotiators protect your bottom line and your peace of mind—turning pressure into strategy and offers into wins. Skilled, savvy, and relentless when it counts.

Problem Solvers

When things get messy, we get focused. Our Problem Solvers anticipate obstacles, untangle challenges, and keep your deal moving forward—no drama, just solutions. Calm under pressure. Obsessed with results.

Marketers

We don’t just list homes—we launch them. Our Marketers create buzz, attract the right buyers, and turn properties into must-haves. Strategic, data-driven, and built to sell fast (and for more).